Sunday, February 26, 2012

Saturday, February 25, 2012

Friday, February 24, 2012

Thursday, February 23, 2012

Tuesday, February 21, 2012

Sunday, February 19, 2012

MRC - MRC Allied, Inc.

Chart update... Not a recommendation for buy, sell, or hold. =) Trade at your own risk. This is my personal TA. Salamat... :)

Thursday, February 16, 2012

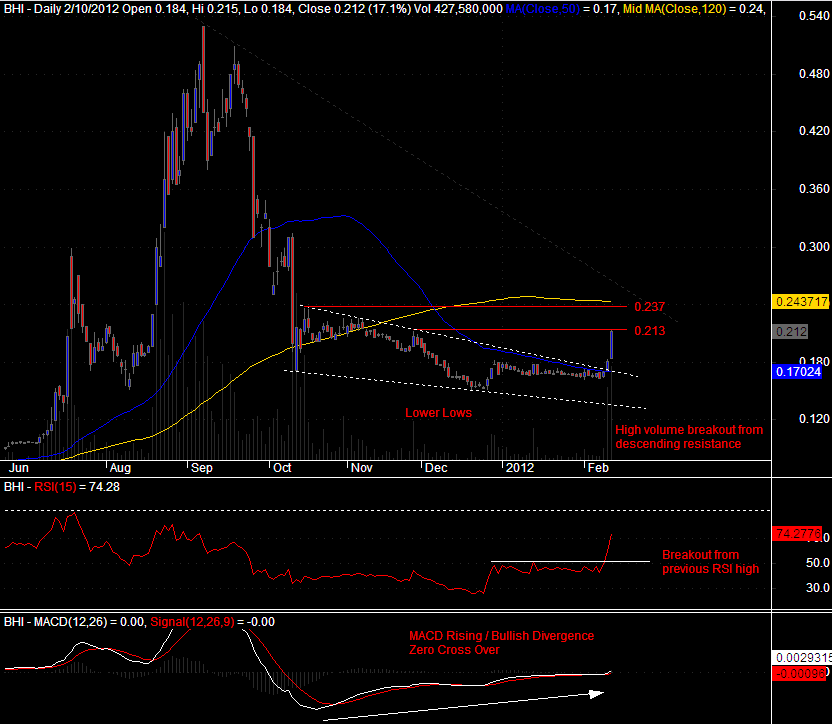

BHI - Boulevard Holdings, Inc.

Chart Update: Critical supports for me are at 50% (0.20) and 61.8% (0.19) using Fibonacci retracement tool.

Pd: Sold half the other day.

Pd: Sold half the other day.

Tuesday, February 14, 2012

MRC - MRC Allied, Inc.

Daily - We see a MACD Bullish Divergence. Current pattern is a Falling Wedge. It is now testing the descending resistance of the Wedge. If breakout tomorrow, it needs another high volume + RSI (30) needs to break 54.46. This will help validate that breakout and momentum upward is valid. Another good signal to watch is if price does a crossover to 50 and 120dma. If breakout not successful, see you at 0.24

Weekly - Formed a Bullish Bat and Stochastic showing a good signal.

Weekly - Formed a Bullish Bat and Stochastic showing a good signal.

14Feb - Daily Bread

Planning for tomorrow is time well spent; worrying about tomorrow is time wasted. Sometimes it's difficult to tell the difference. Careful planning is thinking ahead about goals, steps, and schedules, and trusting in God's guidance. When done well, planning can help alleviate worry. Worriers, by contrast, are consumed by fear and find it difficult to trust God. They let their plans interfere with their relationship with God. Don't let worries about tomorrow affect your relationship with God today.

Matthew 6

34 "So don't worry about tomorrow, for tomorrow will bring its own worries. Today's trouble is enough for today.

Matthew 6

34 "So don't worry about tomorrow, for tomorrow will bring its own worries. Today's trouble is enough for today.

WPI - Waterfront Philippines, Inc.

0.50 and 50 is the value (price and rsi) to monitor for me... breakdown on that value means cut loss for me. Breakout from 0.56 and rsi 56.64 if a good signal for me...

Sunday, February 12, 2012

Wednesday, February 8, 2012

LC - Lepanto Consolidated Mining Company

LC critical support at 1.54... Stochastic already at support. There is a possible price bounce at this level and

do a range trade... Initial resistance at 1.63 then 1.80. If breakdown from 1.54... this might be confirming the

Double Top. Last January, binenta ko na remaining shares ko kay LC dahil sa Bearish Divergence.

08Feb - Daily Bread

Some of those in the crowd were experts at telling others what to do, but they missed the central point of God's laws themselves. Jesus made it clear, however, that obeying God's law is more important than explaining it. It's much easier to study God's laws and tell others to obey them than to put them into practice. How are you doing at obeying God yourself?

Matthew 5

19 So if you ignore the least commandment and teach others to do the same, you will be called the least in the Kingdom of Heaven. But anyone who obeys God's laws and teaches them will be called great in the Kingdom of Heaven.

Matthew 5

19 So if you ignore the least commandment and teach others to do the same, you will be called the least in the Kingdom of Heaven. But anyone who obeys God's laws and teaches them will be called great in the Kingdom of Heaven.

Tuesday, February 7, 2012

7 February 2012 - Daily Bread

Can you hide a city that is sitting on top of a hill? Its light at night can be seen for miles. If we live for Christ, we will glow like lights, showing others what Christ is like. We hide our light by (1) being quiet when we should speak (2) going along with the crowd (3) denying the light (4) letting sin dim our light (5) not explaining our light to others (6) ignoring the needs of others

Be a beacon of truth-don't shut your light off from the rest of the world.

Matthew 5 14-16 NIV

Be a beacon of truth-don't shut your light off from the rest of the world.

Matthew 5 14-16 NIV

Monday, February 6, 2012

TA - Trans-Asia Oil & Energy Dev't Corp.

Weekly - Formed A Descending Broadening Wedge. Initial TP if breakout is at 1.48

Daily - Equal lows and lower highs... 3 weeks old triangle. Forming a Descending Triangle? Pennant if it breaks out this week. Descending Triangle if it breaks down next week.

Saturday, February 4, 2012

Stocks to monitor - Feb 6 to 10, 2012

BHI

Daily - Forming a Falling Wedge Pattern supported by a possible Bullish Divergence. Price is making lower lows while MACD is rising or making higher lows. This type of Divergence signals for a possible trend reversal. Red box below seems like a consolidation zone. However a breakdown from that support will probably send the price to 0.15, 0.14, up to 0.13... For now I am observing and accumulating at the lows. I don't know if it will soon move up and breakout from 0.17 and 0.18... My exit strategy is to cut loss below 0.16...

Weekly - A candidate for Bullish Hidden Divergence. If support holds or bounces at the rising trend line, this might confirm the Bullish HD. In Bullish HD, price is making higher lows while oscillator is making lower lows. This means that there is a possibility that it may continue its up trend.

Daily - Forming a Falling Wedge Pattern supported by a possible Bullish Divergence. Price is making lower lows while MACD is rising or making higher lows. This type of Divergence signals for a possible trend reversal. Red box below seems like a consolidation zone. However a breakdown from that support will probably send the price to 0.15, 0.14, up to 0.13... For now I am observing and accumulating at the lows. I don't know if it will soon move up and breakout from 0.17 and 0.18... My exit strategy is to cut loss below 0.16...

Weekly - A candidate for Bullish Hidden Divergence. If support holds or bounces at the rising trend line, this might confirm the Bullish HD. In Bullish HD, price is making higher lows while oscillator is making lower lows. This means that there is a possibility that it may continue its up trend.

Friday, February 3, 2012

Stocks to monitor - Feb 6 to 10, 2012

Stocks to monitor - Feb 6 to 10, 2012

Subscribe to:

Posts (Atom)